The new refusal of the student debt crisis first evidenced by the Occupy Student Debt Campaign appears to be spreading and to have good cause. Student strikes are shutting down Montréal, while new evidence makes it clear how serious the crisis is now and how it is going to get worse soon.

The new refusal of the student debt crisis first evidenced by the Occupy Student Debt Campaign appears to be spreading and to have good cause. Student strikes are shutting down Montréal, while new evidence makes it clear how serious the crisis is now and how it is going to get worse soon.

In Canada, Quebec has proposed doubling tuition over the course of the next five years. As it currently stands at roughly $2500, state authorities claim that tuition will still be lower than in other states and affordable. Students counter that nonetheless lower-income students will be deterred from college and that once the idea of substantial increases is conceded, they will become the new normal. Their resistance today has included shutting down the port of Montréal and a demonstration that even the media concede is around 100,000.

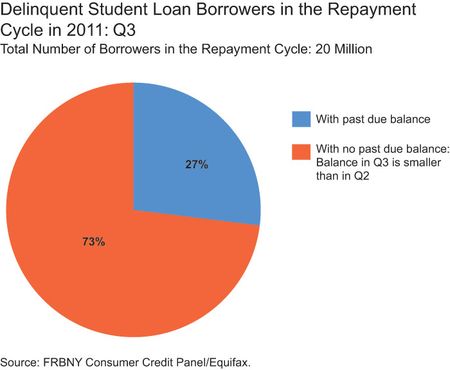

People there have obviously looked to the American situation. The Federal Reserve Bank of New York has released a report giving striking new data showing both U. S. student debt and rates of delinquency reaching new highs. Unsurprisingly students have concluded that either tuition comes down or they will stay away.

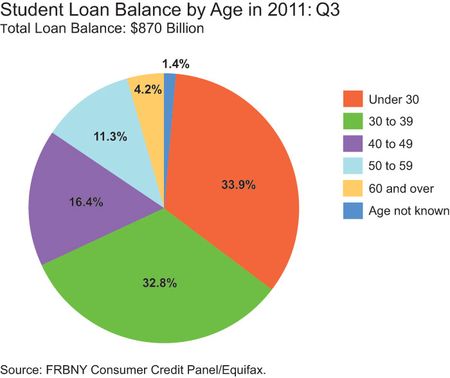

According to their calculations, student debt is now at least $870 billion, the largest category of personal debt in the country, surpassing both the total credit card balance ($693 billion) and the total auto loan balance ($730 billion). This was already known but their analysis breaks it down further. $580 billion of the total student loan debt is owed by people younger than forty. About one million people owe more than $100,000. By excluding those people currently in deferral because they are still in education, it can be seen that 27% of debtors are either behind payments or in default.

That percentage is set to increase still further. The Obama administration has changed the regulations so that new federally subsidized graduate student loans will incur interest while a student is still in school as of July 1, 2012. As those loans currently attract 6.8% interest, a student in school for the six to nine years it takes to acquire a doctorate would find their loans had ballooned before they had even graduated.

That percentage is set to increase still further. The Obama administration has changed the regulations so that new federally subsidized graduate student loans will incur interest while a student is still in school as of July 1, 2012. As those loans currently attract 6.8% interest, a student in school for the six to nine years it takes to acquire a doctorate would find their loans had ballooned before they had even graduated.

For a long time universities have believed that they are immune to all protests for two reasons. Student debt is the most secure loan available, one that cannot be mitigated by bankruptcy, unemployment or old age. Loan companies can and do garner Social Security. Combined with what administrations believe is the unquenchable desire and need to gain degree qualifications for work, this security has given universities the confidence to raise tuition to the current levels.

Now the first sign has come that students are no longer lured by the Pied Piper of the career path. Applications for the Law School Aptitude Test, required for admission to law school, dropped by 16% this year. The combination of insane debt and 40% unemployment amongst newly-qualified lawyers was enough to deter nearly a fifth of potential candidates. What if other students are thinking the same way? High tuition schools without an endowment to back them up will become the Lehmanns and the Bear Sterns of the student debt bubble.

If we decided that higher education was “too big to fail,” it would cost $70 billion a year to make all public higher education free. Once that would have seemed like a lot of money. After the last few years, it seems like the bargain it is.