In academia, we are discouraged from taking a straightforward view. Perhaps the most popular academic words are “complex,” “complicated” and “more” when attached to one of the first two. The financial crisis does, however, strike me as straightforward: the blatant crimes of the banks culminated three decades of wealth transfer from poorer to richer. As the anniversary of Occupy Wall Street approaches, this should not be forgotten or set aside.

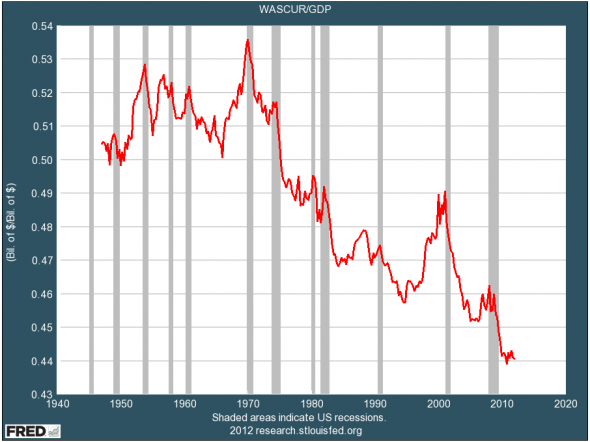

This point was brought home by seeing some charts produced by the Federal Reserve and published on the Business Insider blog. Here to begin with is a chart showing the value of wages in relation to gross domestic product.

It’s easy to see that since the 1973 oil crisis in general, and the beginning of Reaganomics in 1980 in particular, wages have steadily declined until falling off the cliff in 2008, from which there has been no recovery. Unsurprisingly, therefore personal debt has risen in accordance.

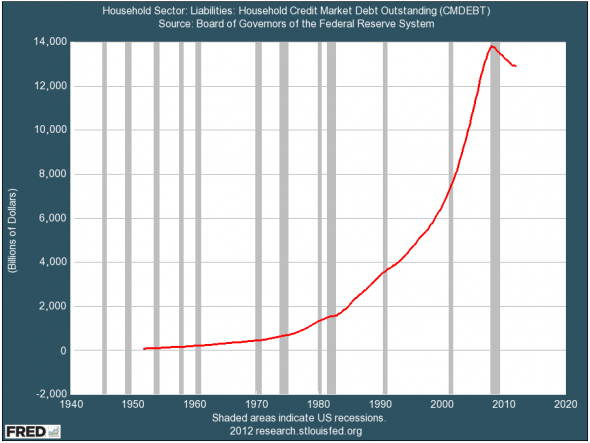

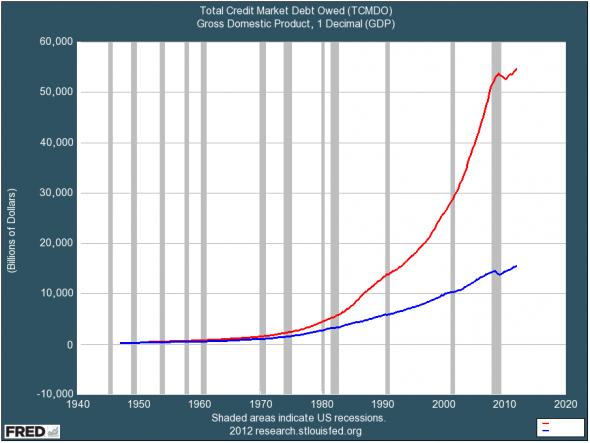

In 1973, household debt was negligible. It is now over $14 billion. The apparent slight improvement since 2008 is the effect of record numbers of bankruptcies, foreclosures and credit card write-offs. Corporate and government debt rose in parallel. The consequence can be seen below, where debt is the red line and gross domestic product is the blue line.

Clearly, this is not sustainable: or so you would think. Government has concentrated primarily on reducing its own debt, a largely meaningless affair except insofar as it further impoverishes those dependent on state support or using state-financed health care. Isn’t there a problem with financing all this state debt? Actually, as far as the U. S. goes, no, not at all. Liberal Paul Krugman points out the obvious in today’s Times, namely that markets are

buying government debt, even at very low returns, for lack of alternatives. Moreover, by making money available so cheaply, they are in effect begging governments to issue more debt.

Some U. S. government debt is so cheap, it actually costs investors money to get it.

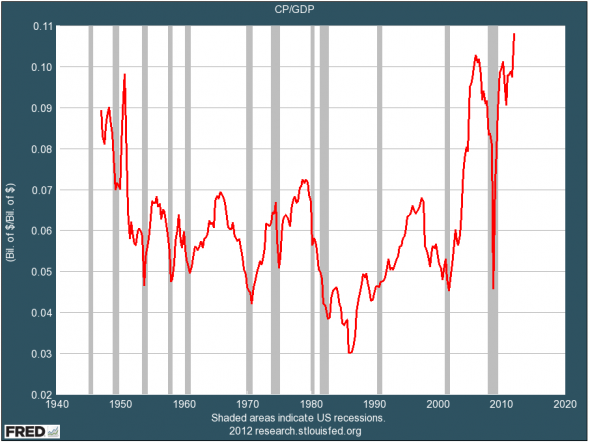

So it’s clear that you could, if you wanted, do many creative and interesting things with what is in effect free money, like abolish personal debt. If you want to see why this isn’t happening, then look at this chart showing corporate profits:

After a nasty hiccup in 2008, profits are roaring above all post-war levels, with only the Cold War boom even coming close and then only very briefly. This level of return is very desirable for those we have called the one percent and they are willing to do anything to defend it.

And yet, even this wasn’t enough for them. At Barclay’s Bank, center of the LIBOR scandal, yet more criminal activity has been uncovered. Jerry del Missier, the former Chief Operating Officer of the bank during all this crime has even been handed a $13.6 million farewell package.

The activism is about changing the way that we imagine ourselves in relation to debt. It means embracing government borrowing at historically low levels to relaunch the economic lives of the 99%–and then making sure neo-liberalism can’t happen again. The outrage, the anger and the sadness comes from the astonishingly brazen theft by corporations and banks for which no-one has yet even shown remorse, let alone be punished.

On September 17, and for the years after it, let’s show that we haven’t forgotten these simple lessons.