Here’s an exciting new initiative from Strike Debt: the Rolling Jubilee. This project will raise money by means of a benefit and other donations to buy back debt in default: and abolish it. Whereas the traditional Jubilee has been a gift of the overlord to the subjugated, the Rolling Jubilee is mutual aid by and for the 99%. The project is set to launch at the People’s Bailout on November 15 at Le Poisson Rouge, Bleecker Street, New York (tickets are not yet on sale).

The event casts light on a shadowy area of American financial markets, where banks and other lenders sell debt in default at very low rates between 5 and 10% of face value. The purchasers are normally debt collectors, who then try to extract some percentage above what they paid out of these most destitute of people. A couple of home truths emerge from the very existence of such markets.

Banks and other lenders do just fine with such a return because all debt is a way of creating new money. By getting a return of 5%, the bank has that much more new money rather than having lost the 95% not repaid by the debtor, as we might imagine. Next, as a society, we traffic in this misery. 15% of Americans are now being pursued by debt collectors. The Rolling Jubilee will buy what it debt it can on these markets: and abolish it.

The Bailout will be an evening of guest performers doing music, comedy, and variety together with speed teach-ins and debt-related performances. Local community groups and Occupy workgroups will be there as well and it promises to be an amazing night. It will be livestreamed, so it’s also a Telethon. On the night, there will be ways to donate to the Jubilee, and all money so donated will be used to abolish debt. The target is $50,000 which would abolish an amazing $1 million of debt.

That’s a drop in the ocean of debt, of course. It’s just a beginning, both to the Jubilee and to the awareness of how debt operates in this society. If we collectively decide to be active both in abolishing debt–$5 abolishes $100 of debt!–and in opening a new discussion about the kind of country that makes money selling debt, then the Jubilee will be rolling.

Questions will be asked about how exactly the abolition will be carried out and I don’t as yet know the answers to them but I’ve been told that once the mechanism has been fully prepared, it will be announced. Already, it does seem clear that it’s not really possible to target any one person’s debt for abolition. I did a Google search myself and quickly came up with a company called LoansMLS, who are willing to sell me debts as varied as $30 million of second mortgages in California at 10% of face value or a $36,500 home improvement loan at 8%. But you can’t find out specific information about the debtors and that’s presumably the last vestige of privacy they/we have left.

What matters here are not so much the technicalities of this process as the debate it needs to open about debt as a commodity. For all the rhetoric about the morality of repaying debt, banks don’t seem to need more than these small percentage returns to be ahead. A debt abolition on a general scale would be the greatest stimulus to the economy imaginable, as people who had hitherto scraped every penny together they had to send to banks that don’t even need it, would now be able to spend that on goods and services. That’s 15% of the entire population that could be helped, even before we get to underwater mortgages, Federal student loans (which are not resold) and high-interest credit-card debt.

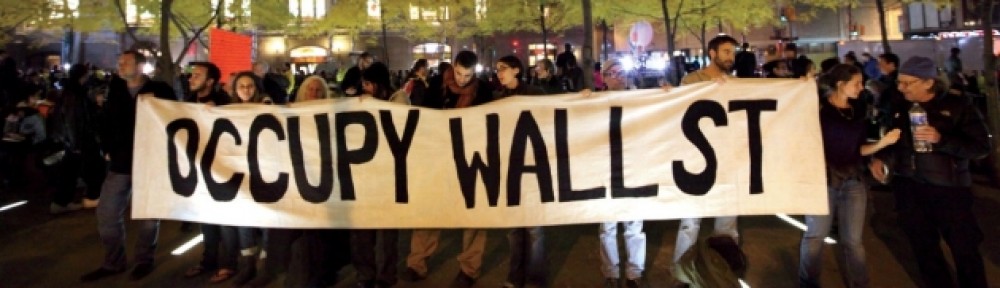

Beyond even that benefit, it’s time to talk about what kind of a society we really want to live in. Have we so little imagination that the only possible discussions are whether or not to cut taxes for the wealthy, or who said the word “terror” when? Are we not better than that? Clear your calendar for the People’s Bailout, an evening a year to the day after the mean-spirited and illegal eviction of Occupy Wall Street, when we look ahead to our better futures.

Pingback: Lessons Learned After One Year of Occupy D.C. - D.C. Mic Check

Pingback: This is the movement | Occupy 2012

If you really want to stick it to Wall Street, here is what you should do:

Don’t JUST abolish the debt you acquire.

STEP ONE. After you pay the bank and take its non-performing debt off its books (perhaps you can have a ceremony in Zucotti Park where you present Lloyd Blankfein with a large cardboard check), you should RESTRUCTURE the debt in light of the borrower’s situation. One-percenter took out a subprime mortgages on a superfluous vacation home, hoping to “flip” the property as an investment? Tax him. Saintly, socially conscious vegan needthe ed to finance a sabbatical from work in order to devote his full attention to the Obama campaign? Forgive him. But preserve at least some of your receivables for…

STEP TWO. Take all your remaining, restructured receivables and deposit them into a special purpose vehicle (“SPV”). This is an entity that’s “bankruptcy-remote,” meaning its credit risk is insulated from yours, even in the event of bankruptcy — it’s a trick Wall Street doesn’t want you to learn, because it’s helped *them* escape debt slavery for decades. Now, here’s the fun part: by having this SPV issue certificates representing ownership interests in the outstanding receivables, you can actually sell the debt back to Wall Street — perhaps at a profit! You will need to overcollateralize, obvi. But S&P will help you determine levels and a pro supp is super easy to generate with so many templates online.

This will be ultimate act of debt resistance.

BRILLIANT!