There’s a wildcat strike against debt going on. The numbers are remarkable. By definition, a wildcat strike can’t be organized and, in this case, can’t really say speak its own name. That’s why OWS has a Strike Debt campaign: to articulate the crisis, to end people’s shame at being in debt and to encourage them–us–to speak out. Send us your story to strikedebtresearch[at]gmail. No contact details will be released.

Numbers

27 percent of student loans are in default and that number is rising.

$1.2 trillion of mortgage debt is underwater (debt exceeds value of property) or about one-third of all properties.

5 million homes have been foreclosed and 5 million more are under threat of foreclosure, meaning that owners are in default or behind on payments. 300,000 people had a foreclosure notification added to their credit report in the first quarter of this year. 27% of mortgages are seriously delinquent–ironically, a slight improvement. 300,000 more people went bankrupt.

The average credit card debt per household has fallen from $17, 936 in 2009 to $14,336 now: because of mass default. In 2010, credit card companies had to write off fully 10% of all debt.

Numbers Don’t Tell the Whole Story

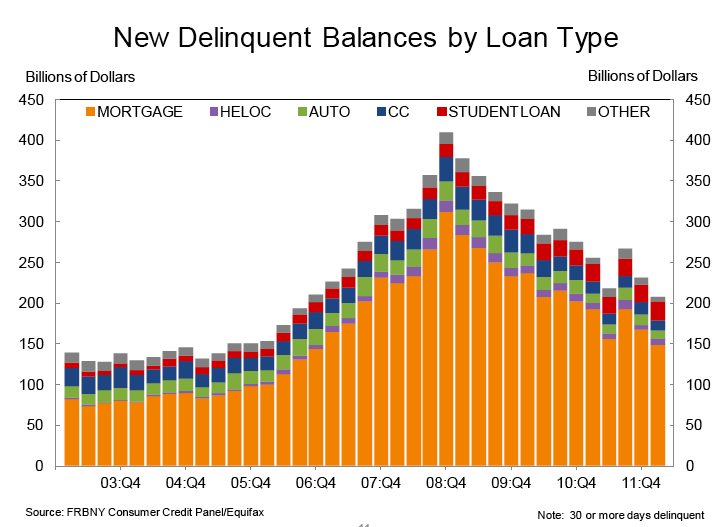

So although we see delinquent debt totals falling, it’s not just because people are striving to pay it back but because it has been written off or put into foreclosure. Adding all this up, the Federal Reserve Bank of New York estimates:

As of March 31, 9.3% of outstanding debt was in some stage of delinquency, compared to 9.8% on December 31, 2011. About $1.06 trillion of consumer debt is currently delinquent, with $796 billion seriously delinquent (at least 90 days late or “severely derogatory”).

Student debt is more indicative in this regard. Using their own calculation on student debt, which has it at $904 billion, the Fed indicate how serious the student debt issue has become relative to other debt:

Since the peak in household debt in 2008Q3, student loan debt has increased by $293 billion, while other forms of debt fell a combined $1.53 trillion.

That decline in other debt includes write-offs, bankruptcies and foreclosures, options that are not available for student loans. In this sense, student debt provides the clearest picture of what’s happening, precisely because it cannot be manipulated off the books like other debt.

Lenders know this and have cut back credit. Mortgage originations for the first quarter of 2012 were down 17.4% from even 2011, let alone 2007. Try and get a credit card with an interest rate under 15% once the “grace” period expires. The average credit card rate is now 16.94%. This is usury in a time when bank interest rates are at all-time lows, on average 3.25%. That’s a 500% mark-up, even before you get to fees, memberships and so on.

The Morality Question

All this data is public knowledge. What we need to make public is that people are clearly making the choice to refuse repayment of debts. While the PR machine of the debt industry has long asserted that debt refusal is immoral, the ongoing debtors revolt proposes that it is compulsory endebtedness that it is immoral.

What I mean to suggest is this: lenders are actively deceitful. Playing by the rules as presented to us as consumers leads to massive shortfalls. Students were told to contract debt as a means of getting high-paying jobs that are not available, homeowners were encouraged to borrow and refinance as much as they could because house prices never went down. These are people trying to play by the rules, only to discover that the game is fixed.

For corporate persons, as the Supreme Court has it, this kind of utter imbalance has been rectified by debt forgiveness, restructuring and other finagling. Miss a payment on a credit card or a student loan and you get hit with a penalty fee, increased interest rates and a shot credit rating. MF Global used $1.6 billion of its clients’ money to try and save their firm–and they “could face a negligence charge.” Morality has nothing to do with debt.

What we have seen with debt, as with other areas of social life, is a secularization of Catholic doctrine. In this way, confession became secularized as therapy, for example. St Thomas Aquinas, the fearsome medieval theologian, argued that there is a debt of punishment for sin that cannot be expunged:

sin incurs a debt of punishment through disturbing an order. But the effect remains so long as the cause remains. Wherefore so long as the disturbance of the order remains the debt of punishment must needs remain also.

Of course there was a way out: you could purchase an “indulgence” allowing the debt of punishment to be bought out. In the secularized form, being in debt is seen as punishment for the failure of the debtor to be sufficiently wealthy. As capital now is the highest form of value, sinning against debt is the worst sin of all.

The Credit Rating Scam

Many people are afraid to speak out about debt because they fear it will impact their credit rating. These ratings are scams. As we’ve already seen, lenders are pre-emptively withdrawing credit and increasing rates and fees. If you don’t have a loan and it’s not student debt you’re after, the credit rating score required to get the “best” deals has become so high that no-one who really needs a loan is likely to qualify. So the loan you will get will already have punitive levels of interest.

How Can You Join In?

You don’t have to refuse to pay your own debt to join the debt strike. Here are some ideas:

Speak out. Debt is immoral, not debt refusal. Challenge people who say “they borrowed it, too bad, they should pay it back.” If you’re in higher education, talk to your colleagues about debt, emphasize the risks involved and think of alternatives.

Research. In your area, what’s happening? Do you have a story to tell? Email strikedebtresearch [at] gmail

Take action. Create debtors assemblies where you live. Look for the online materials coming from the Strike Debt campaign to help you. Create a Tumblr or other off-the-shelf websites. One idea that has floated is to collectively buy and forgive loans in default. There are websites where you can buy defaulted loans for a small percentage of the face value. The commercial loan market operation hopes to recover more than that percentage and so make a profit. It’s real bottom-feeder stuff. So even if we can’t actually afford it, let’s expose this kind of scam.

Remember: Debt Is Fucked Up and Bullshit. You Are Not A Loan.

This is a sloppy usage of the term “strike” and anyone defaulting on their loans know that the “choice to refuse repayment of debts” is one made largely out of compulsion. It is “made” by people with the choice between servicing their loans or paying heat or electric bills, feeding themselves or children, paying health costs, or whatever else. There is a huge amount of personal sacrifice. And until people figure out how to *really* initiate a debt strike — in which strikers are protected from additional fees, destroyed credit ratings, and their wages or public service benefits being taken from them as penalty — this debt “strike” will be just as much worth the name as if I don’t go to work tomorrow, which is, not a strike, but the termination of my income, hence, my means of existence.

Nick,

Thanks for another thought provoking and compelling article. Debt, as it is applied today, is the perfect neo-liberal ball and chain. It functions to atomize and shame. What better form of control could there be? The shortsightedness of the neo-liberal elite is that they underestimate the strength and power of solidarity. All Power To The People!

As you illustrate, debt is only a choice for those who want stuff they don’t need. For the rest of us, who were indebted for health and education, it was a different situation. If we cannot obtain food, shelter and medicine by working and paying taxes, debt is all that is left. Since our debt was caused by those who benefited from bailouts and other frauds, they should assume them.

Before we can occupy the world, we might have to occupy the Treasury and the IRS.